The tax year in the UK starts on 6 April and ends on 5 April of the following year.

Taxes are an unavoidable part of every citizen’s life, and understanding the UK tax year is crucial for individuals and businesses alike. Whether you run a business, are self-employed, or work in a corporation, knowing the key dates and deadlines helps to steer clear of penalties and other charges. Proper financial planning, including analyzing your profit and loss statement, can help manage tax liabilities efficiently.

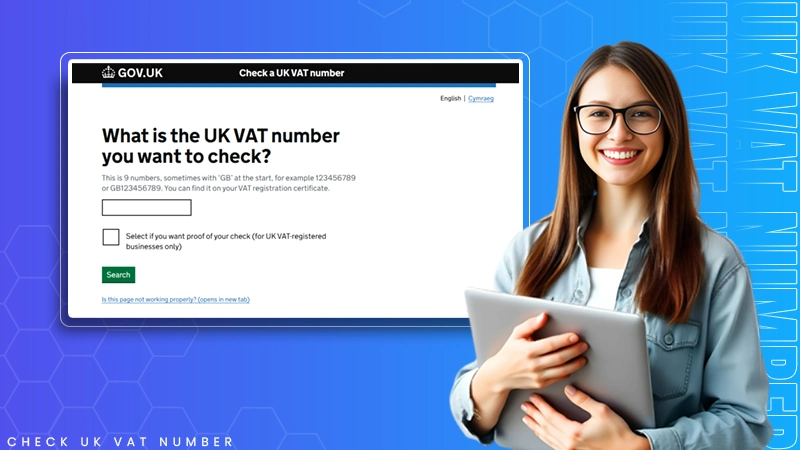

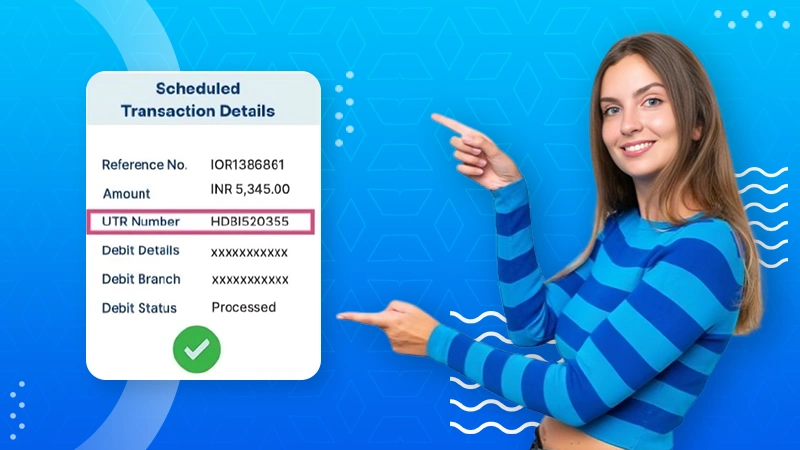

But When Does the New Tax Year Start? What is the UK tax deadline that taxpayers need to follow? Ensuring you have the correct tax identification, such as your UTR number, is essential for filing taxes correctly and avoiding unnecessary delays. We have answered all these queries in this blog. Read below to learn about tax regulations, methods, and more.

What are UK Tax Year Dates?

Tax year is the period individuals and organizations calculate their revenue and earnings and report to the government for that particular period. The UK Tax Year or the fiscal year, is the time your tax will be calculated and deducted as per your basic duty. Proper financial planning, including monitoring cash flow and understanding key financial metrics like the accounts receivable days formula, can help businesses manage their finances effectively throughout the tax year.

The start date is 6 April and the end of tax year date is 5 April. For example, if you want to count for the financial year 2024/2025, the duration is from 6 April 2024 to 5 April 2025.

Note that every country has their timeline counted as a financial year. This April to April period works only when you are paying taxes and reporting to the British government.

Deep Insight: The British adopted the Gregorian calendar in 1752, which automatically shifted the tax year dates to 25 March. However, due to frequent adjustments and additions of 11 days, the Dates Tax Year ended up coming to 6 April.

What are the Key Tax Year Dates and Deadlines?

Whether you are running a business or are in a corporate job, if your income comes under the tax bracket, you need to pay the necessary amount. It is by the way beneficial for companies and individuals as well because it showcases a top-notch FICO score, allows loans easily, and helps to access government schemes. But to enjoy the benefits, you must not miss the deadlines and submit the requirements on time.

Here are some UK tax deadlines you must know about:

- 6 April: Commencement of the 2024/2025 fiscal year.

- 31 May: Employers must provide P60 forms to employees, detailing earnings and tax deductions for the last tax year.

- 6 July: Final date for employers to present P11D and P11D(b) forms, outlining the benefits and expenses offered to employees.

- 31 October: Final date for submitting self-assessment tax returns for the 2023/2024 tax year.

- 31 January: Final date for submitting online self-assessment tax returns for the 2023/2024 tax year and settling any taxes due.

- 31 July: The second payment on account is due for the following tax year.

Note that if you miss out on these dates, you will have to pay potential penalties for not meeting the compliance on time.

Self-Assessment Tax Returns: Overview

Self-employed individuals, people with other income sources that are not reported at the source, and landlords usually file under the category of self-assessment tax returns. This system allows taxpayers to file their incomes and take advantage of government relief and grants. The first step to take is to register yourself as self-employed, and you are good for self-assessment returns.

Method to File

- Online Filing Method: You can choose to submit your documents online at the HM Revenue & Customs (HMRC) portal. It allows submission any time till the English Tax Year deadline, i.e., 31 January.

- Offline Method: If you do not want to take the online route, you can go for paper submission. Just fill in all the tax-related documents and send them to your local government offices. The UK tax year deadline is 31 January of the following fiscal year.

PAYE (Pay As You Earn) System: Overview

The PAYE system is regulated by the HMRC over the entire nation. It collects income tax and National Insurance Contributions from all the employees. According to this system, the employers deduct the money from employee’s salaries before giving them out. Proper business accounting services can help companies manage payroll efficiently and meet their tax obligations.

Here are some key forms that are crucial under this category:

- P60 Form: Provided each year to employees, outlining total earnings and deductions for the tax year.

- P45 Form: Issued upon an employee’s departure from a position, showcasing earnings and deductions up to the last working date.

- P11D Form: Details benefits and expenses given to employees, including items like company vehicles or health coverage.

- Tax Codes: Utilized by employers to establish the accurate sum of tax to withhold from wages.

Taxation of Different Businesses in the UK

As there are multiple types of businesses, each of them comes under different tax obligations. Knowing the types of business and its fundamentals is crucial to understanding its tax requirements and benefits. Proper financial management, including a bookkeeping service for business, can help ensure compliance with tax regulations and accurate record-keeping. Let’s go through each type of business below:

Sole Traders

A sole tradership or sole proprietorship is a category of businesses run by an individual. The sole traders have complete control over their business, its assets, and profits after the taxes.

For a sole proprietorship, these are the key points:

Income Tax: Calculated from earnings after permissible costs.

- National Insurance Contributions (NICs): Class 2 and Class 4 NICs are determined according to income.

- VAT (if relevant): Companies with income over £90,000 (starting in 2024) are required to register for VAT and apply VAT on taxable sales.

Limited Companies (Ltd)

Limited companies are businesses whose identity is different from its owner’s. This acts as a separate legal entity in which shareholders are only liable for the invested money. Limited companies get ownership to raise money through private and public funding schemes. Managing financial transactions effectively, such as accounts payable services, is crucial for maintaining a company’s financial health.

For the tax payouts and benefits, these are the key points for limited companies:

- Pay Corporation Tax: As of 2024/2025, it is currently established at 25% on profits, but small enterprises with profits below £50,000 benefit from a reduced rate.

- Submit Company Tax Returns: Required to be filed yearly with HMRC.

- Send Annual Accounts: Necessary for Companies House. Keeping track of outstanding payments and managing accounts receivable services can help businesses maintain accurate financial records.

- PAYE for Workers: When employing personnel, businesses are required to manage a PAYE payroll.

Limited Liability Partnerships (LLPs)

Limited Liability Partnerships are companies that are built on a combination of partnerships and aspects of corporations. LLPs have their own identity as partners, meaning they have the right to own assets in their own name.

Filing tax returns for Limited Liability Partnerships differs from the other two types. Here are the key aspects to note:

- Partners are Subject to Income Tax: Earnings are shared among partners, who declare their income through self-assessment.

- No Corporation Tax: In contrast to limited companies, LLPs do not have to pay Corporation Tax.

- VAT and PAYE: LLPs might be required to register for VAT and implement PAYE if they employ staff.

What are the New Updates on UK Tax?

The government changes policies and makes new rules regarding tax payments after the elections or in between the party’s ruling sessions. Every taxpayer must stay informed about the changes and take action accordingly. Proper financial management, including business confirmation statement filing services, ensures companies remain compliant with evolving tax regulations.

Here are some UK Tax Year changes made by the government, as of 2025:

- Increase in Taxes: Companies are expecting higher expenses from government payroll tax increases. The new regimen is set to take effect in April 2025.

- Concerns About Economic Growth: The country is going through a slow economic expansion, with GDP increasing by just 0.1% in the last quarter of 2024.

- Council Tax Hikes: Every household with high income will encounter substantial tax increases beginning in April 2025. The expected rise is considered to be 10%.

- Making Tax Digital (MTD): Starting in April 2026, the government will widen MTD obligations for self-employed persons and landlords with incomes over £50,000. Proper financial reporting, including dormant accounts filing services, will become increasingly important for businesses maintaining compliance.

These are the certain updates and additions done in the tax regulations of the UK.

Additional Tips for the Taxpayers

While you are paying tax, here are certain things that you must keep in mind:

- Check Your Tax Code: You must know the correct tax code so that you don’t end up overpaying or underpaying tax payouts.

- Keep Updated Records: Make sure to update your income records, other sources of income, and documents required.

- Leverage Tax Allowances: Ensure to take advantage of tax benefits like marriage, business-related, and other deductions.

- Contact Tax Advisor: If you are filing a tax report for the first time or handling a business, consider hiring a financial advisor who can help you save taxes and guide you properly.

Understanding tax guidelines and knowing the UK tax year is important in order to file tax reports on time. Note that taxpayers need to stay informed and updated with the revised law for a seamless process. For businesses dealing with financial challenges, restructuring their liabilities through corporate debt restructuring can be a viable option to maintain financial stability and meet tax obligations on time.

We have covered everything from “When Does the New Tax Year Start” to new tax regulations made by the government. Read this blog whenever you want to understand more about tax payments. Share the info with your friends and family too!