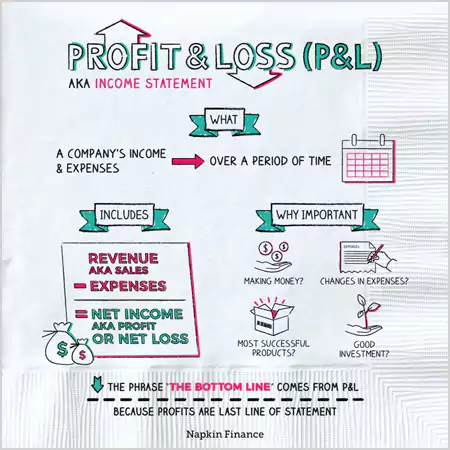

A profit and loss statement includes a business’s revenue, list of goods and services sold, operating expenses, interest rate, taxes, net profit, and more.

A Profit and Loss (PNL) statement, often referred to as an income or expense memo, serves as a versatile financial asset for your business, detailing how much money you’ve earned, spent, and saved over a specific period of time.

However, interpreting the PNL statements can feel overwhelming due to the extensive number of datasets involved if you’re not well-versed in complex financial terminology and raw data.

Hence, keep reading till the end to gain clear insights into the PNL statement breakdown, along with information related to managing these statements effectively.

Working Procedure of Profit and Loss (PNL) Statements

The profit and loss statement is one of the three financial statements summarizing a business’s costs, revenue, and expenses during a specific period. Additionally, it helps nearly every company manage its workflow and understand the actual numerical figures of how much profit and loss a business generates. If you’re running a company in the UK, you may also need to comply with dormant accounts filing services for inactive businesses.

Profit and loss statements are also referred to as:

- Income statement

- Statement of profit and loss

- Statement of operations

- Financial or Income statement

- Earnings statement

- Expense statement

Basic Framework to Create Profit and Loss (PNL) Statements

Mostly, every commercial entity uses accounting software programs to generate profit and loss statements, as well as to track down financial transactions and expense figures. But what if you’re a small business?

Well, in that case, you can create your PNL statement using a basic spreadsheet and some easy mathematical formulas by following the steps below.

1. Track Revenue

Tracking revenue is the first step to creating a PNL statement. It means keeping meticulous records of the amount you received in payments for your products or services. If you need a seamless way to manage payments, accounts payable services can help handle supplier payments efficiently.

2. Examine the Cost of Sales

Now, after tracking down the revenue generated, examine the cost of sales, which means deciphering the cost of inventory, raw manufacturing materials, additional staff you hired, and more. nderstanding these costs is crucial, just like ensuring business confirmation statement filing to meet UK compliance requirements.

3. Calculate the Gross Profit

Further, to obtain the precise figures and gross profit, deduct the examined cost of sales from the total revenue your business generated. Additionally, now calculate the operating income, which can include rent, staff, advertising, equipment leases, and phone expenses.

4. Net Profit

To get the exact figures of net profit, subtract the operating income and the cost of sales from the overall revenue generated, and now you’re left with your net profit. A well-maintained corporate debt restructuring strategy can also help businesses optimize cash flow and improve financial stability.

5. Final PNL Statement

Draft the final statement and calculate the exact figure using the formula below. If the result is positive, the company makes a profit. If the result is negative, it suffers a loss.

Basic Profit and Loss Statement Formula:

This statement is based on a simple formula starting with the total sales revenue for a particular accounting period.

Formula❗

Net income = Revenue – Expenses + Gains – Losses

Let’s understand it better through an example: By the end of the financial year, a business made $500,000 from sales and generated $20,000 from each sale. During the same year, the business had $100,000 worth of expenses and lost $50,000. Using the abovementioned formula, net income can be calculated like this:

Net income = Revenue – Expenses + Gains – Losses

$500,000 – $100,000 + $20,000 – $50,000

Net income = $370,000

Furthermore, comprehending financial statements can be challenging, which is why you should get corporate accounting services and consultations to examine financial information and offer expert guidance.

Other Elements of Profit and Loss (PNL) Statements

The profit and loss account reflects the gross profit and loss suffered by the business by precisely understanding the numerical figures of operating income, inventory expenses, and more. But here are a few more elements that might affect the Profit and Loss (PNL) statement; give it a good read:

- An account statement must be prepared for each ledger account as a foundation step for handling the profit and loss statement. Preparing PNL statements requires accurately examining the closing balance.

- Create a trial balance sheet to summarize all the ledger accounts. This sheet lists every account with the closing balance from individual statements.

- A compiled list of all goods and services involves the direct costs required to produce products or deliver services, which is needed to obtain precise data on the cost of goods and services sold (COGS).

- Other than the miscellaneous expenses, interest payments and the count of depreciated assets or resettlements influence the overall cash flow or PNL statements.

- Besides gains and losses, earnings before taxes (EBT) is another main subcomponent of understanding profit and loss (PNL) statements. It helps compare and analyze the businesses’ performances.

- Lastly, earnings per share (EPS) is an integral part of the financial market, as it helps investors decide whether they want to invest in a company. Businesses can calculate their EPS by dividing the net income by the number of shares.

Analyzing Profit and Loss (P&L) Statements

Analyzing the profit and loss statements can feel like you are stuck in a stack of statistics, but it can help you figure out how your business is evolving over time and the profits you made. At last, it is worth the grind.

- The primary aim of analyzing the profit and loss statement is always checking how your business is doing. So, head straight to the end line of the statement. If it is ‘in the black’ (you made a profit), and if it is ‘in the red’ (you made a loss).

- Once you check the profits and losses, take a deep glance at your income streams and expenses, as it helps determine where the money went. Additionally, if your business had a loss, you can consider cutting off the unnecessary operating costs.

- Always keep a firm eye on previous data, as the financial market sometimes experiences seasonal downtime. Once you have made your comparisons, you’ll better understand what’s working for your business and what’s not.

- Lastly, most people use Excel spreadsheets to create P&L statements, so double-check all the numerical figures and formulas. Sometimes, manual data entry can lead to tiny mistakes in numbers, which affect the final outcome.

Importance of PNL in Businesses

As you know, PNL statements are an essential tool for businesses to evaluate their financial performance and make responsible decisions. So, here is a compiled outline of how PNL statements stand out as a significant choice for businesses:

- Offers detailed insights into the company’s financial health, revenue, and other expenses

- It helps in making informed and responsible decisions.

- Lets you comprehend the areas for improvement.

- Tracks financial progress over time from different periods.

- Delivers insightful information into financial management and assists organizations.

Wrapping Up!

Understanding complex financial abstractions such as profit and loss assertions, payroll , cash flow, and balance sheet statements can be perplexing. Still, we’ve broken them down in the most straightforward manner possible.

Regardless of how complicated PNL statements may appear, they are crucial for enhancing your business workflow and effectively managing financial transactions. Furthermore, professional services like self-assessment tax return services and accounts receivable services can streamline your operations. To maintain accurate financial records and streamline your business finances, professional bookkeeping services can help track transactions and manage financial statements efficiently.