Yes, it is pretty simple to delete a Cash App account. Go to your account section, follow the account closing process, and that’s it.

Cash App or you can say it Digital Wallet, the payment portal allows users to make transactions. Although it is providing various features, don’t you think you should try something new and more advanced? Well, if you are getting the same thought then you need to know how to deactivate a cash app. You might have different reasons to delete your account from the portal, but our focus is it guides you on what you want.

So, this blog is specifically for users who want to close CashApp accounts for security reasons or just want to switch services. Learn all the necessary prerequisites, how to delete my Cash App account, and all the related information.

How to Delete My Cash App Account? — Prerequisites

Cash App is a wonderful platform with tons of features, which include trading Bitcoins and stocks as well. The crypto and stocks you buy through the Cash App are stored in the digital wallet of the platform and will vanish if you do not transfer or sell them before deleting your account.

If you have business finances managed through Cash App, you may consider switching to specialized business accounting services for better financial tracking and management.

Deleting a Cash App account might sound simple, and in a way, it is. However, there are certain things that you need to look at before making that big decision. You can look into the subscriptions, pending payments, and penalties. Here are a few important things you need to do:

Clear Account Balances

How to delete your cash app account? Let’s start with the basics. The first thing you should do when you think of closing a Cash App account or any financial account is to clear out all the funds. Link another financial account and transfer the money directly into it.

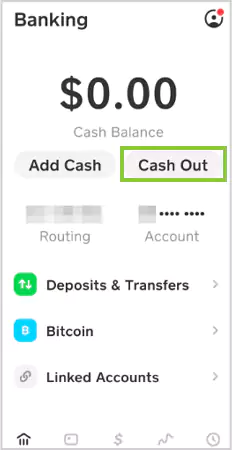

Here’s how you can do it:

- Launch the Cash App on your device.

- Go to the Banking section, which is in the top left corner of the homepage.

- Click on the Cash-Out button and enter the amount.

- Check your existing balance, type it, and follow the prompts.

- Now select the mode of deposit—instant with a fee or standard with a free option—but it takes 3 business days.

- Follow the on-screen instructions and wait for the amount to drop into your linked account.

- For businesses dealing with client payments, ensuring you have accounts receivable services in place can simplify the transition.

Cash Out Bitcoins and Stocks

Bitcoin: Launch the Cash App and go to the Bitcoin section on the homepage. Here, click on Cash Out, fill in the amount of the asset, and select Allow to confirm.

Stocks: Log in to your Cash App account and go to the Invest section. Here, scroll through to see the stocks and their numbers you hold. Tap on them and click on Cash Out to liquify your asset. If you’re planning to reinvest your funds, learning about the PNL formula can help you analyze gains and losses better.

Check Pending Payments

You must check all the pending payments or transactions that will be processed in the future. Either you can reroute the upcoming payment to another mode or wait until to close the account.

Make sure to:

- Cancel all the possible transactions if possible.

- Check if you have received money for the refund request.

- Verify the deposits and withdrawals.

Neglecting these things can cause big blunders like service continuation failure, loss of funds, and even a decline in financial score.

Stop Automatic or Recurring Payments

If you’re using Cash App for recurring transactions like streaming services, music services, gym memberships, or online grocery shopping, you need to check if the service is still ongoing or not. Update the payment closing on the official sites or app and cancel the subscriptions or another payment method.

If you’re switching platforms for improved payroll services, consider exploring payroll services in the UK to streamline employee payments effectively.

Note that this is important to do, or the bounce payment penalties will start accruing, decreasing your credit score.

Download Cash App Transaction History

Cash App account transaction history is as valuable as your bank account statements. So, before you delete your account, make sure to download the history for your tax records or other purposes. If you’re self-employed, recording these details is crucial when filing your self-assessment tax return.

Note that once the account is closed, you cannot retrieve it or get any record. Follow the steps below to export the transaction history:

- First, launch the Cash App on your device.

- Go to the Statement section in the top-right corner of the homepage.

- Scroll through the transaction history. Tap on the filter button to select the dates and select Export CSV.

Now you can use this e-statement history wherever needed or for personal finance recording.

How to Deactivate Cash App?

Once you have fulfilled all the requirements, you can proceed to smoothly close Cash App account. Here is the step-by-step process to follow:

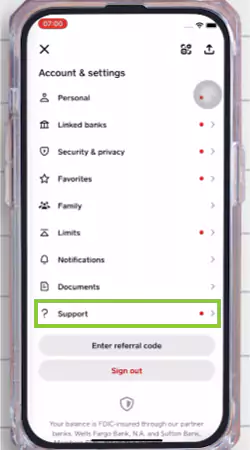

- First, go to your Cash App account on your mobile or desktop.

- Go to the Profile section in the top-right corner of the homepage.

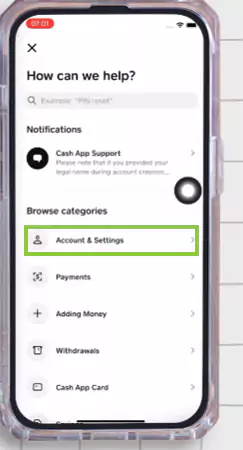

- Now, scroll down to select the Support tab.

- You’ll be redirected to the next page. Here, click on Account & Settings and select the Something Else button.

- Now, scroll through the list of options and tap on Account Settings.

- On the pop-up, tap on Close Account.

- You will see more options on the new page. Tap on Close Your Cash App Account.

- Lastly, read all the terms and conditions carefully and click on Confirm Closing Account.

As you complete the steps of how to delete my Cash App account, your account will be closed permanently. The company will send you an account closing confirmation email to your registered email within 24 hours of processing.

How to Uninstall CashApp?

After deleting CashApp account, there’s no point in keeping the app consuming space on your device. So you better uninstall it and remove all the cache and cookies to optimize your handset.

iPhone: Unlock the device and long-press on the Cash App. >> Click on the Delete App option from the pop-up. >> Confirm by tapping Delete.

Android: Search Cash App, then long tap on icon.>> Slide the app to the trash bin. >> Click on the Uninstall button.

Can you reactivate your Cash App Account?

Once you’ve permanently closed your existing or previous account, there’s no chance that you can reactivate or claim the same account again. However, to use the Cash App again, you can create a fresh ID from scratch.

How to Delete Cash App Account Information Permanently?

Customers of the p-2-p service have certain rights to ask the platform to delete or remove their personal information under the California Consumer Privacy Act (CCPA). If you don’t have any plans to switch back to Cash App anytime soon or in the future, it is good to remove your info from the site you no longer wish to use.

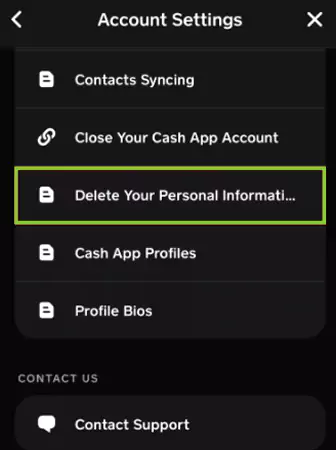

Here are the steps to do so:

- First, click on the account profile on the top right section of the homepage.

- Scroll down and select the Support button.

- Here, click on Accounts & Settings.

- Scroll down to select the “Delete Your Personal Information tab.”

- Go through the details carefully, then tap on the Chat button.

- Follow the prompts to initiate the process.

That’s it; all your personal information will be removed from the Cash App customer data and record.

What to Expect After Deleting Cash App Account?

Well, if you wonder how to delete cash app account, you already know the steps to do so, which are pretty straightforward. However, you can face several changes if you are using it as the main medium of transaction. Here are certain changes you need to watch out for:

- Your account has been permanently closed, which means you will not be able to access it in the future.

- Your $Cashtag (username) is disabled and might be released to someone else.

- All upcoming payments, automatic transfers, or pending transactions are annulled.

- Although Cash App deletes the majority of your data from its servers, certain information might be kept for legal or compliance reasons.

- If a person attempts to transfer funds to your closed account, they will see an error notification indicating that your account is no longer available

Note that you need to ask people to stop sending money to your $Cashtag as the service might give it out to another user.

What are the Alternatives to the Cash App?

With a number of online payment services available in the market today, it can be confusing to understand which one’s better. Well, it all depends on your usage and preferences. However, to make it easy, here are some online payment apps that you can call an ideal Cash App alternative.

Venmo: A payment application with social features, owned by PayPal.

- Charges up to 3% for overdraft and credit card usage.

Zelle: Quick transfers between banks connected with numerous major financial institutions.

- 0 charges for anything.

PayPal: A popular payment platform utilized for personal and commercial transactions.

- 2.9% of the total amount is charged for using PayPal credit and debit cards.

Apple Pay and Google Pay: Digital wallets for contactless transactions and online shopping. Both offer similar services. Apple Pay is only available on the Apple device network, whereas Google Pay is accessible to all.

- No costs or charges on usage.

Square Payments: A powerful payment processing solution, perfect for companies and independent contractors.

- Charges 1% of the total amount for ACH bank transfers.

- 3.3% for credit card payments.

Chime: A mobile banking application that offers features such as early direct deposit and no-fee overdrafts.

- The premium version charges $3-$15 with maximum benefits.

These are the few alternatives that have a strong market presence and are trusted by millions of users worldwide.

Wrapping Up!

If you are not satisfied with Cash App’s features or just want to explore other platforms, it is the right choice to close a Cash App account. This way, your $Cashtag will be misused too. However, note that if by chance you leave money in your wallet, that amount will be blocked, and you can’t get it back as the account will be permanently shut down. To ensure your business records are in order before transitioning, consider working with a reliable bookkeeping service for business to keep your finances on track.

We have explained all the prerequisites and how to delete cash app account in this blog. Hopefully, this will help you carry out the entire process smoothly. Share the info with your friends and family, too!